One of the important roles the BRBAA Advisory Council plays is ensuring the financial stability of the Big Red Bands organization year in and year out. We work together with the undergraduate student leadership to ensure that band is in a strong financial standing for years to come, while allowing the current band members to enjoy a busy and productive year supporting Cornell Athletics.

Financial Operations Review

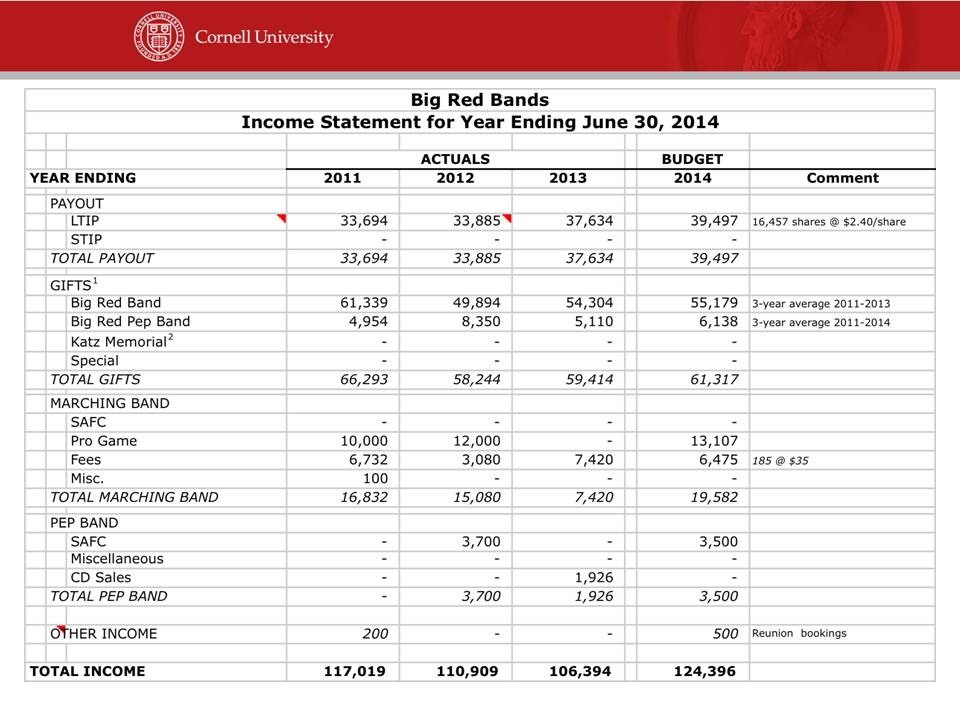

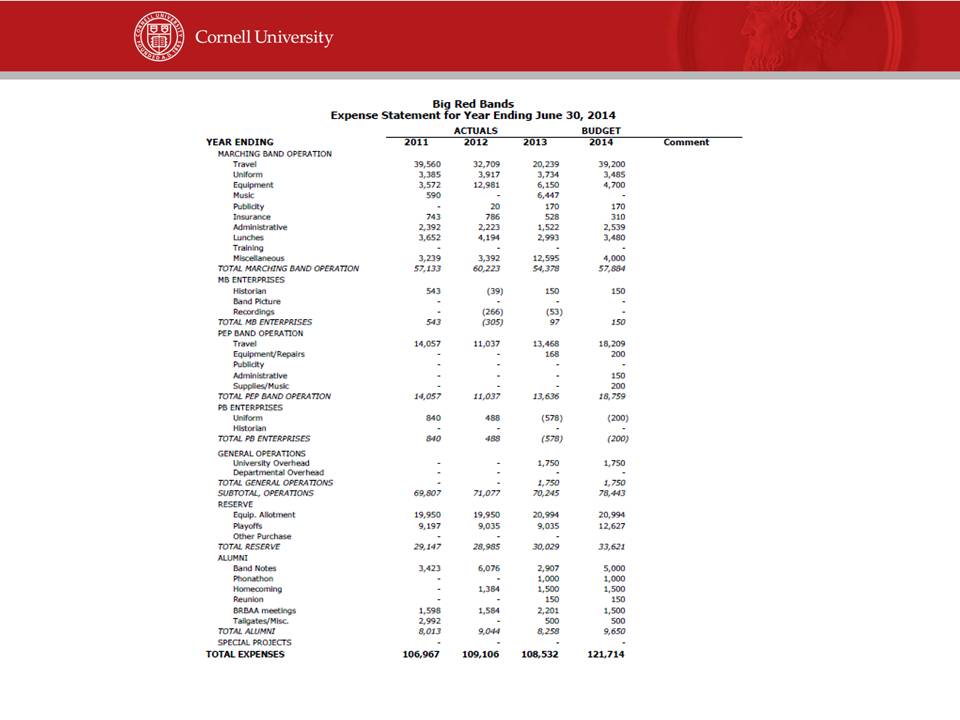

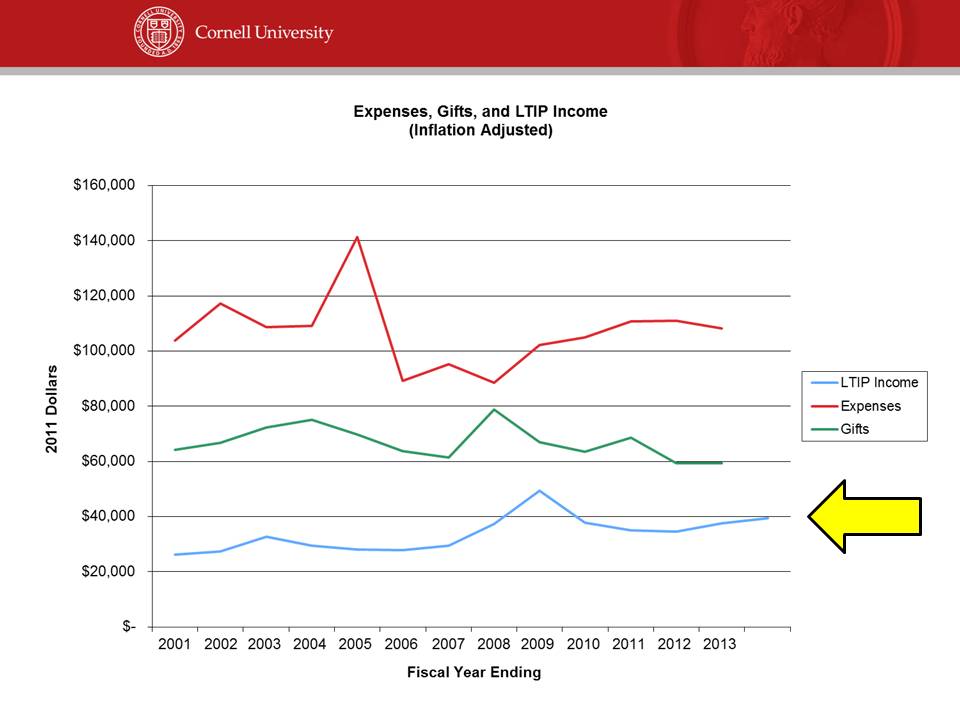

The bands have two primary sources of income: annual gifts to operations and payout from endowment. Throughout the course of a typical year, band alumni and supporters commit an average of about $60,000 in gifts to the organization. The majority of these gifts is donated directly to the bands’ operations, and is used within the year. In addition, the bands generate about another $40,000 in income from long-term investment payouts from the Cornell endowment. The Bands spend about $80,000 each year on operations and $20,000 on reserve expenses, which is money set aside for long term purchases (such as uniforms, tubas, and percussion). The largest expense for both bands is travel, which, including playoffs, accounted for 55% of expenses in FY2013. At the end of each fiscal year, the bands typically break even, with any surplus saved to re-invest in endowment shares in the future. These are very rough numbers.

FY2013

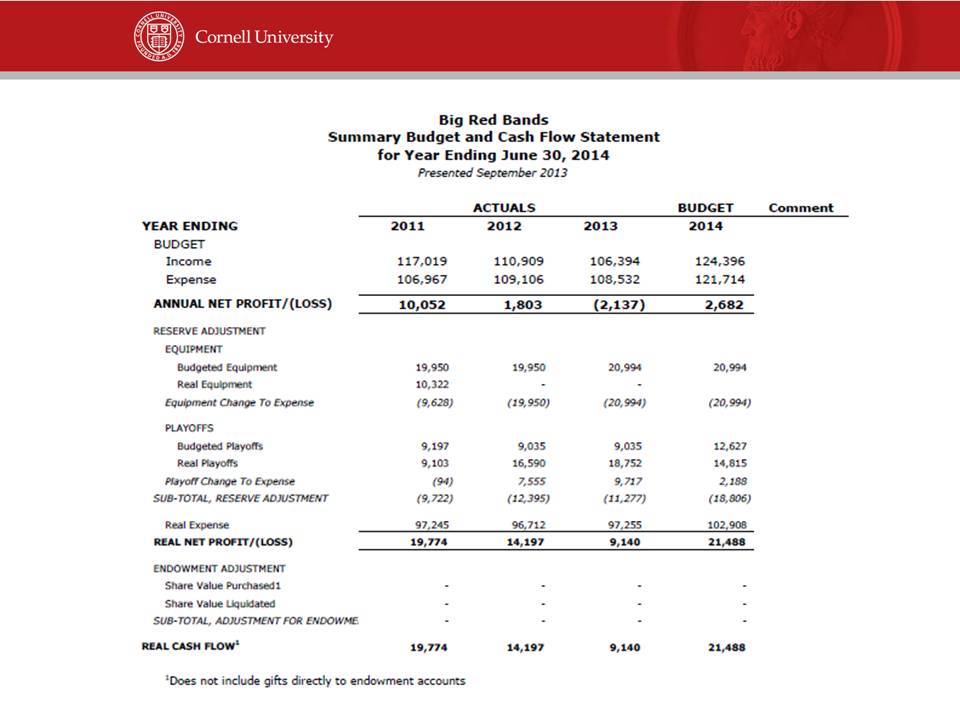

The summary of the Bands’ budget is shown below.

Long Term Performance

This first slide shows the value of the Bands’ endowment accounts over time. This is a nice picture, but it is essentially meaningless as we only spend the payout from these accounts and don’t use the principle.

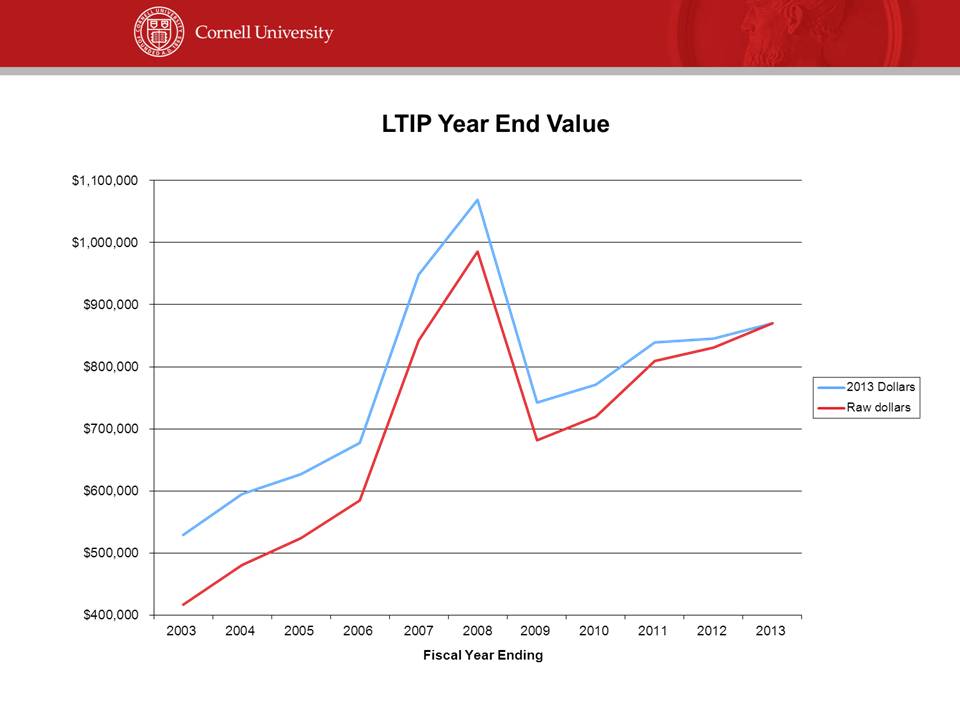

The second slide shows our total share in the University’s long term investment pool (LTIP). A large portion of this is from those initial “Second Century Fund” drives, but an equally large portion is from responsible budgeting and overages over many years. Unfortunately, overages are harder to come by these days, but regardless, we have nearly doubled our number of shares.

We have not sold shares, but because we now put budget overages which are reserved for equipment acquisitions down the road here instead of leaving them in non-interest bearing accounts for 10 years, we will liquidate a relatively small number of shares when we purchase uniforms. We will never, ever liquidate shares that people gave with the intention of establishing an endowment. Ever. We couldn’t if we wanted to. It has to do with how various accounts are set up – we have a number of LTIP accounts – and some can NEVER be touched, which is good.

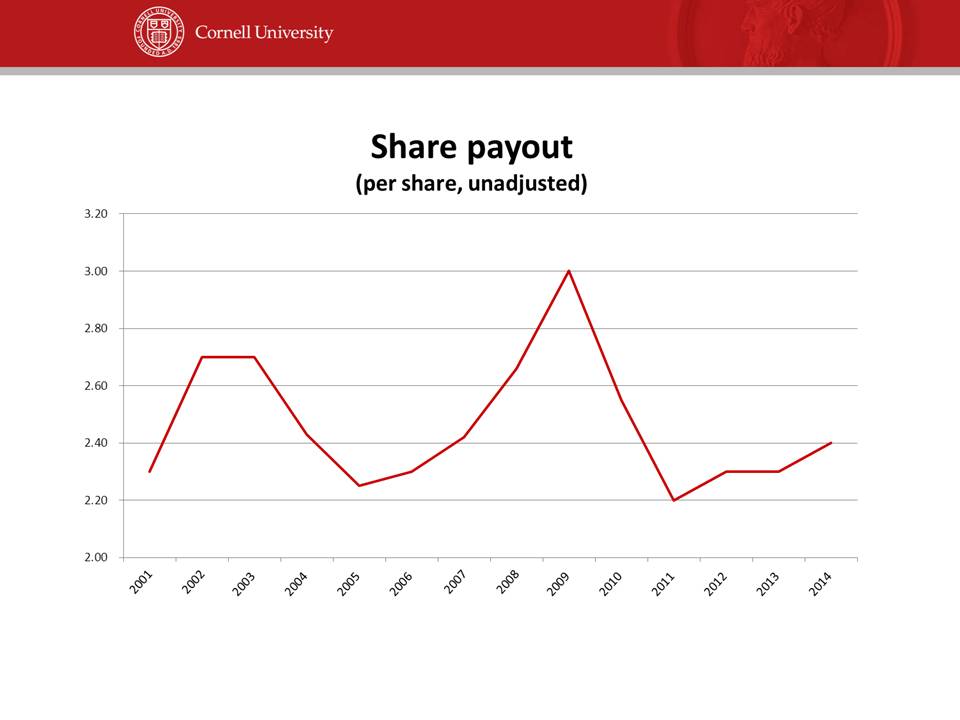

The next graph shows the payout per share, which is determined by the University Board of Trustees.

The last slide shows our gifts, expenses, and LTIP payout over time, all adjusted for inflation. As you can see, BRB alumni are steady and reliable. The one trend is that LTIP payout has increased, and that is a direct result of responsible management by the Alumni Association, as we have prudently re-invested in the LTIP. Notably, this has occurred despite a flat (and at times declining) share payout.

Brian Adelman ’09

Nick Janiga ’00

Lowell Frank ’99